Get the latest news and stories about geothermal straight to your inbox.

In 2018, Department of Energy passed a Federal Tax Incentive for geothermal ground source heat pumps called the Investment Tax Credit (ITC). In the form of personal tax credits, these incentives save Dandelion customers thousands of dollars.

As a New York State homeowner, you qualify for the New York State Energy Research and Development Authority (NYSERDA) New York State Clean Heat Program. The State of New York and the 6 electric utilities that serve New York State have allocated substantial funding for ground source heat pump installations. Dandelion is an approved Participating Contractor in the program.

As a Connecticut homeowner you can qualify for DEEP (Department of Energy and Environmental Protection) geothermal heat pump incentives. Connecticut homeowners can qualify for $1,000s in geothermal incentives. Details are listed below.

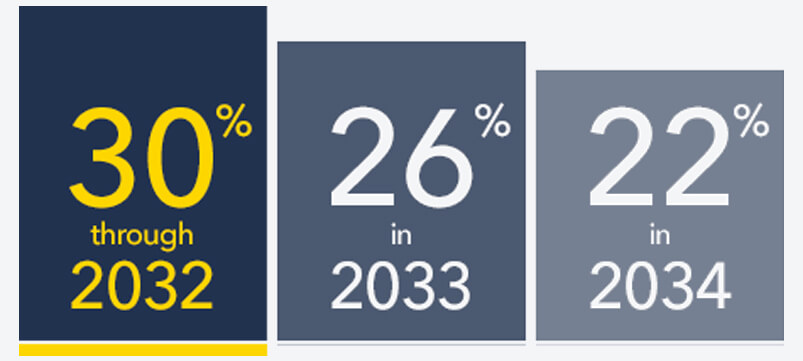

In 2021 and 2022, the federal tax incentives known as the Investment Tax Credit (ITC) will cover 26% of a Dandelion geothermal system. However, the percentage covered by the ITC will decrease to 22% in 2023, and 0% in 2024.

SEE IF YOUR HOME QUALIFIESNew York State's Clean Heat Program is administered by the homeowner’s utility. Let’s go over some important details to explain how these incentives are allocated.

Each utility has a unique incentive.

The incentive amounts are based on the installed heat pump’s total heating capacity BTUH.

A geothermal heat pump containing a desuperheater qualifies for an additional incentive.

Both Eversource and United Illuminating offer geothermal heat pump incentives via the Energize Connecticut program (The following municipal utilities are not part of the Energize Connecticut program; Groton, Bozrah, Norwalk, Wallingford, and Norwich).

The Connecticut incentives are limited to $10,000 per household, or a 6.67 ton geothermal heat pump. See the table below for an example of what an average sized home that needs a 5 ton geothermal heat pump system would qualify for in Connecticut.